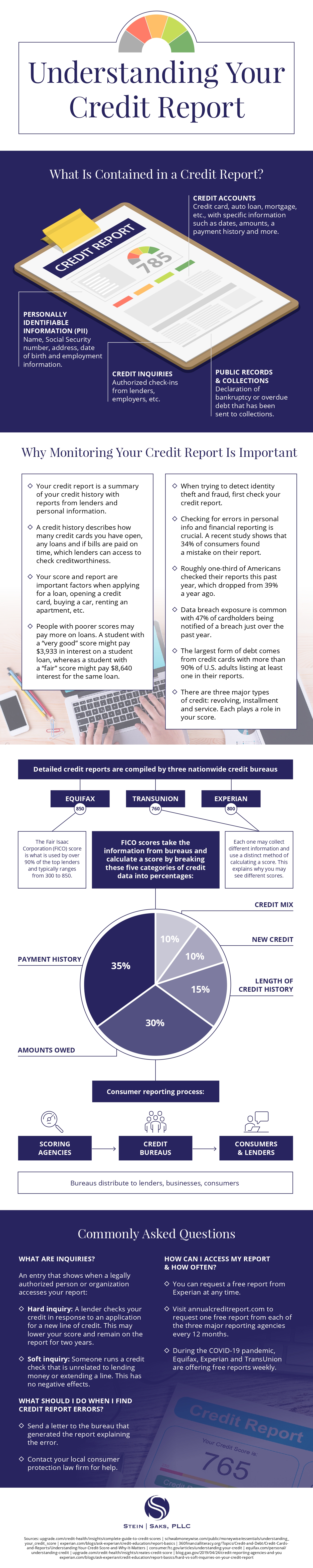

Understanding Your Credit Report

When seeking an auto loan or mortgage, your credit report acts as your financial calling card. It provides banks and lenders with insights into your suitability as a borrower, evaluating the likelihood of your repayment based on your financial history and the information within the report.

While many people are familiar with the credit score, this numerical representation is an amalgamation of various data points derived from your past financial activities. While it offers a quick snapshot of your financial standing, it doesn’t convey the complete narrative on its own.

Comprehending the intricate details within your credit report holds significance for several reasons. Beyond offering a more nuanced perspective of how lenders perceive you, it can serve as a guide for making informed decisions about your financial choices.

Your credit report presents a comprehensive history of your credit cards, loans, and bills, along with your repayment patterns. For instance, you may assume you’re in good standing, but a recurring pattern of late payments could impact your ability to secure a new car loan or lease an apartment. Identifying such patterns in your report provides an opportunity to rectify any lapses and work towards improving your credit score.

One cannot conceal their financial history from credit-providing institutions. It’s imperative for everyone to be aware of what their credit reports communicate about them and comprehend the potential consequences. For further insights, refer to the accompanying resource.

This infographic was created by Stein Saks, a TCPA lawyer